EBITDA: Dental Practices & DSOs

For dentists and dental support organizations (DSOs) there is one common tool that both entities use from time to time. Hint: it’s not a sickle probe.

Whether you operate 1 office as a solo practitioner or manage 50+ practices as a CFO, you need to be able to reliably gauge how your business is doing. EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is an accounting measure that serves as a proxy to calculate a company’s operating cash flow.

EBITDA is calculated by taking your total revenue and subtracting all operating expenses (except interest, taxes, depreciation, and amortization). As a “bottom line” number on your income statement, EBITDA is useful for investors since it’s easily calculated and can be compared to other competitors within the dental industry. In fact, EBITDA is the metric on which most businesses in the world are measured – banks, private equity, and financial firms use EBITDA to put a number on a business’s value and analyze it for investment or lending decisions.

Why is EBITDA important for dental practices?

Dentists who are planning an exit or retirement, or those who wish to pass off the operational headaches of their practice and focus solely on clinical, have a significant interest in raising their business’s value prior to a sale. In some cases the difference in payout can be hundreds of thousands, if not millions, of dollars.

This is where dental support organizations (DSOs) come into the picture. Previously, buyers of dental practices – namely, other dentists – were restricted to as much capital as banks would lend them. According to the dental M&A experts at Tusk Partners, most banks have a lending ceiling of 80-90% of annual revenue. But with the advent of private equity-backed DSOs in the dental industry, it’s now possible to secure additional capital for a deal since private equity groups are not constrained by what a bank would offer the average dentist looking to buy a practice.

More importantly, private equity groups are measured on EBITDA themselves. They don’t look at a dental practice’s revenue when considering an acquisition – they are focused on the EBITDA and how that number could increase their own EBITDA. Typically DSOs will pay a multiple as high as 4-6x a dental practice’s EBITDA so long as the business acquisition increases the DSO’s collective EBITDA. What this means is that the true value of a dental practice is not simply a percentage of its annual revenue, but often much more.

How strategic procurement can impact your EBITDA

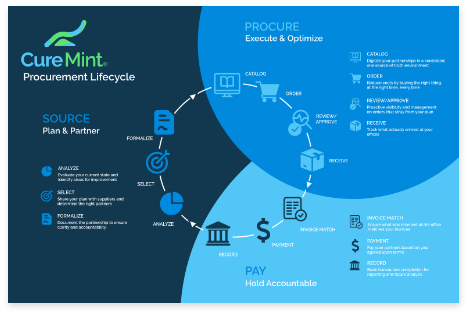

If you own a dental practice you may be wondering, how can I increase my EBITDA? One proven way to improve your EBITDA is to implement operational processes that drive greater efficiency and cut costs. Procurement, as an operational indicator of performance as well as a cost driver, remains one of the best ways for dental organizations to grow their value.

A recent study from Spend Matters shows that if an organization’s spend on non-payroll expenses is greater than its EBITDA, then a 1% decrease in spend will increase EBITDA by more than 1%. In average cases, a 10% reduction in spend can result in a 20% to 40% improvement in EBITDA. This is because procurement savings go straight to a company’s bottom line, acting as an immediate lever, whereas raising top line revenue requires overhead costs. Every $1 of savings is therefore worth much more than $1 of revenue – for some dental practices, a dollar saved could be worth anywhere from $5 to $20 of increased revenue.

Strategic procurement offers dental organizations with a tremendous cost savings opportunity. By making sure that purchasers are buying the right supplies from the right vendors at the right price, an end-to-end solution for dental procurement eliminates rogue spending within a dental organization. Connecting your procurement and accounts payable teams with a holistic procure-to-pay software that uses 3-way invoice matching can also deliver savings by preventing wasteful payments for duplicate or erroneous invoices.

Perhaps most importantly, digitizing your organization’s procurement journey with an end-to-end solution generates robust data that can be intelligently analyzed for cost savings. After all, can you really know how much you’re spending with each vendor when they’re the ones providing your order history? By tracking your supply expenses with spend management software, you can quickly identify spending leaks and create a strategic sourcing plan that cuts costs when it comes time to renegotiate supplier contracts.

Dental procurement software makes a difference

Ultimately, streamlining your procurement process is only one piece of the EBITDA puzzle. There is also staff compensation, insurance, marketing, rent, utilities, and other expenses that make up a group practice’s overhead. Nevertheless, given the cost of revenue spent on raw materials and supplies by dental offices each year, implementing a smarter procurement process is a sure and easy solution to deliver results and boost your EBITDA. See how CureMint streamlines the procurement process while providing data and visibility to facilitate better cash flow management.

Related Blogs

How to Get Started with Dental Spend Management When You Don’t Know Where to Start

09.30.21

For rapidly growing dental service organizations (DSOs), the…

Not All Dental Costs Are Equal: Which One Are You Focusing On?

09.27.21

It doesn’t matter whether you’re whitening teeth or selling…

The Best Way to Increase Productivity for Your Dental Assistants

09.21.21

In many ways the lead dental assistant at your dental practice…